If you are reconsidering your decision to buy a house this year, you are not alone. According to surveys sent out by Fannie Mae, only 35% of respondents believe it is a good time to buy a home. This is an all-time low for the survey, and down from 53% in March of this year. The country has a pessimistic view about the housing market, and we happen to be in one of the fastest moving markets in the country. Many buyers we have worked with have made in excess of 5-10 offers before getting one accepted, and to do that they have had to waive every contingency and escalate 25% above the listed price. As a buyer, this can be daunting. It can lead one to think, “This can’t be sustainable. I’ll wait for this to level out.” Lets take a look and see if historical data and regional forecasts can give us some insight.

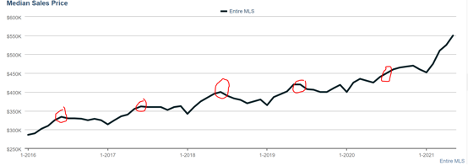

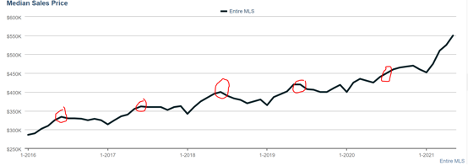

This is the median sales price over the last 5 years of the entire MLS. The red circles are June, and as you can see, June generally corresponds with the “peak” of that year’s sales prices, except for 2020. In 2020, the median sales price continues to grow into the fall before dropping in January. Between January 2021 and June 2021, the median sales price grew by over 20%.

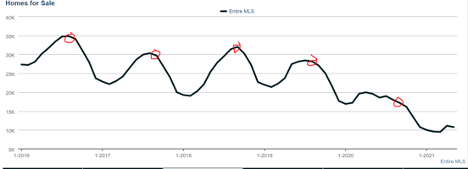

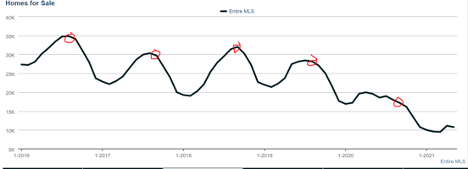

This is the number of homes for sale MLS wide over the last 5 years. The red circles are August. This graph shows us the pattern over the last 5 years is that mid to late summer holds the greatest inventory of homes for that given year. It also shows us the decreasing number of homes for sale over the past 5 years. These graphs together show us as inventory has decreased, home sales prices have increased.

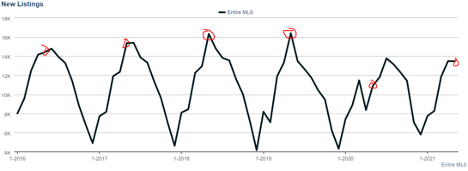

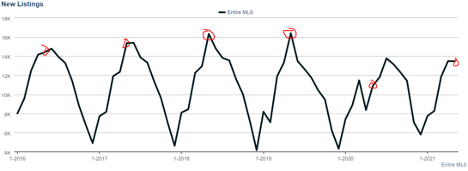

This last graph shows us the past 5 years of new listing activity. The red circles are May. May tends to correspond with the peak of new listing activity every year.

Outside of these graphs, we know that this region has experienced excellent job growth in many sectors over the last 5 years. The Puget Sound Regional Council expects our region to grow by 1.5 million people over the next 40 years. The PSRC conducted a regional housing needs assessment where they translated the regional growth strategy into housing units. In this study the PSRC determined that our region has underbuilt housing over the last decade, which has led to this affordability crisis we are in.

It is important to look at the foundation of the housing market to feel confident in the decision that you are making. According to the PSRC, the affordability crisis we are in right now with housing has been caused by a lack of available housing units, due to under building. We can look at the historical data from the MLS to check that finding from the PSRC, and when we do, we see that over the past 5 years home prices have increased while the total amount of homes for sale has decreased, while new listing activity over the past 5 years has remained relatively constant. This tells us simply that there is more buyer demand than supply over the last 5 years, and that has eaten away at the available levels of housing inventory, confirming the PSRC’s findings that our region has underbuilt housing over the last decade.

So – we know that we have underbuilt housing for a decade, the available housing inventory levels are at record lows, and that new listing activity has not grown much over the last 5 years, and in fact took a dive this year comparatively. We know the PSRC, and every other government agency is planning for an additional 55,000 people to move to our region every year for the next 29 years. We know that interest rates are at record lows still, and we know that the years “2020-2024 have the best housing demographics patch recorded in American history.”

It is hard to buy a home right now, but right now is when you should be doubling down your effort.

With such negative buyer sentiment, many people will take a break from looking. Take advantage of that to get your home. You might be able to get what feels like a deal. There is no economic calamity waiting around the corner that is going to deflate home prices, our economy is in an incredibly strong recovery period. There is no big builder ready to release 50,000 extra units per year, and we have underbuilt for a decade. Next year you can expect prices to be higher, and you can ask your mortgage broker about their opinion on where rates will be. Occasionally we get little pockets in these rising markets that are favorable to buyers. Look at graph 1 just after 2018. It dips as home prices decreased for a couple months. Many buyers bailed and decided to wait, thinking this was the turn of the market. Those that took advantage of the short buyer’s window were rewarded with favorable contract terms and negotiating ability. Those who waited were met with spikes quickly in 2019.